Your “Map” to Total Wealth.

What does it mean to be wealthy?

Wealth means different things to different people.

Wealth means different things to different people.

The original meaning was “well-being.”

What does wealth mean to you?

Perhaps fulfillment, financial prosperity, emotional abundance, the ability to help others, the freedom to follow your passions and to make a profit doing so.

Money. Sometimes it’s a four-letter word.

You might love it, hate it, resent it or crave it.

And if you’re like many creative professionals and self-employed business people,

- It can feel like a struggle.

- You know you’re not living (or earning) up to your potential.

- Sometimes it feels like you have a “love-hate” relationship with your money.

- You’re looking for a way to have more cash for the things that matter to you, and more peace of mind!

I help people overcome financial stress, and I do it by working “from the inside out.”

If budgets, financial advice, and typical business strategies have failed to make a real difference in your life, if you find yourself stuck in the same patterns and frustrations, then read on.

Financial stress and frustration affects 7 out of 10 Americans.

Over half confess to living “paycheck to paycheck” on a regular basis.

If you’re a woman, you’re likely one of the 91% of women who do not feel confident that they will be able to retire with enough money. Money may be a constant source of stress and frustration for you, destroying any sense of inner peace, even if you’re earning and saving.

If you’re a man, it is likely that you feel constantly evaluated and judged by your financial success (or your struggle to achieve the success you desire, but haven’t quite reached). This can affect your confidence, your relationships, everything.

If you’re a business owner, you have the pleasure and the pain of creating your own paycheck. The good news: nobody puts a ceiling on what you can earn! The bad news: Nobody gives you a paid vacation, matches your retirement contributions, or guarantees you a single cent.

Perhaps you are very successful in many ways, but you have not been able to create the freedom and security you desire. Perhaps you have even moved backwards, losing some of the income or savings you once had.

Or you might be embarrassed to say how much you make, not because it’s a low figure, rather because you’re not sure where it all goes.

Perhaps you’re one of the women who is so embarrassed at the state of their finances that they would rather talk about their sex lives than their money. Or one of the women who suffer, at least now and then, with “Bag Lady Fears” of losing it all, even if you own your own home and earn a six-figure income.

You might experience your relationship with money as a “love-hate” relationship. You enjoy spending it, you’d like to have more of it, and at the same time, you find money frustrating, a hassle, and you’d just as soon not have to “deal with it.”

You dread the thought of meeting with your financial planner, if you have one (and you might wonder if you have enough net worth for a planner to want to meet with you anyway).

You have big dreams.

but you don’t see how to pull them off, financially.

Money feels like an obstacle or a trap to you, not a useful tool to reach your dreams.

Perhaps you’ve read financial books and attended seminars, but nothing has changed.

You’re done with avoiding the topic. You’re ready to make a change. But you’re not sure what to do next and who can help you.

For years, I’ve been helping people think and feel differently about money. I’m a holistic wealth coach that deals with matters of wealth and abundance, financial and otherwise.

For years, I’ve been helping people think and feel differently about money. I’m a holistic wealth coach that deals with matters of wealth and abundance, financial and otherwise.

You might say I’m a “Financial Healer” of sorts,

though my work goes beyond the financial realm.

(I like the term “Prosperity Therapy,” since even “Financial Therapy” can be too limiting in scope to address the ways that scarcity can show up in our lives.)

Perhaps scarcity and lack shows up in your life as not enough money. Or you might be suffering from other forms of “not enough”:

- not enough time

- not enough love

- not enough energy

- not enough choices or freedom in your life.

Let’s pull the weeds that are stopping them from experiencing wealth and abundance in their lives. Because while many of us have been planting seeds of abundance and fulfillment, we’ve been watering the weeds!

The key is changing your thoughts and feelings, going beneath the surface symptoms to the root causes of your frustration. Then, I help clients establish new, healthier habits and behaviors.

My clients experience greater success and greater abundance as we work together from a creative, intelligent, intuitive place, free from judgment.

Whatever disempowering story pain you’re going through, I’ve probably been there.

- I’ve been through a business failure and simultaneous divorce.

- I’ve been behind on my mortgage and I’ve lost a home to foreclosure.

- I’ve been a caregiver to an elderly parent with health challenges, and I’ve overcome my own health issues.

- I’ve been in tens of thousands of dollars of debt and have considered bankruptcy.

- I’ve done consumer credit counseling (which I generally don’t recommend) and I’ve re-negotiated with creditors.

- I’ve been prejudiced against “rich people” and used to be a chronic under-earner with a lack of options in my life.

- I’ve also been a six-figure earner and a six-figure spender, carrying bad money habits into a successful career.

- I’ve been a single mom for twenty years. (My daughter is grown and on her own now 🙂

- I’ve been self-employed for twenty years, and have dealt with wide swings of income and high levels of “uncertainty.”

And…

- I’ve learned to love myself for richer or for poorer.

- I’ve learned to LOVE and RESPECT wealthy people, many of whom have become good friends, mentors and partners.

- I’ve learned to create wealth from the inside out.

- I’ve been able to generate real-world financial results, such as $20k in a month, $40k in a month, even $200k in a month!

- I’ve learned to align my spending with my values, and I’ve come to understand the reasons we spend money.

- I’ve changed my mind about money, and I’ve watched my financial results transform as the result.

- I’ve learned to manage my emotions, and I’ve watched my life transform as the result.

- In my latest business, I built a network of thousands, wrote top-rated articles and gained national press recognition (all in less than a year).

- I’ve ghost-written and blogged for top financial advisors and authors, learning about a wide array of investment options (beyond the options within the box that a financial planner can talk about).

- I’ve been a successful investor, building my net worth quickly. (Ouch! And watching much of it disappear in the market crash of2008/2009…)

- I continue to create multiple streams of income, sometimes very quickly.

- I’ve bought homes and rental homes by myself and with investment partners.

- I’ve invested extensively in myself, expanding my knowledge of the wealth mindset, personal development, and financial coaching.

- I’ve helped many entrepreneurial clients up-level their marketing and their marketing results with successful product launches, events, email campaigns and more.

- I’ve also invested in my passions and followed my dreams, becoming a professional singer-songwriter and leaving behind a successful career in real estate to for my mission of helping people live deeply fulfilling lives free from financial stress.

- I’m passionate about helping others become a success by their own definition, and not part of the statistics.

Such as this frightening statistic:

The average social security check for a woman in the U.S. is just over $1,400 a month (AARP) and nearly HALF of women rely on that for 90% or more of their retirement.

$1400 a month.

It’s NOT ENOUGH!

It’s not enough for me, it’s not enough for you, it’s not enough for anyone! And I’m out to make a difference, but perhaps not in the way you might expect.

You see, there are already thousands of fine financial planners, business consultants, and books out there who can give you information and advice.

But something is missing.

It’s the same thing that’s missing when you can’t lose those last 10 (or 50) pounds.

We don’t need more information.

We know that earning more and spending less could help our finances, just like we know that exercising more and eating less might help our figures.

So what DO we need?

We don’t need someone to scold us, shame us, or remind us we’re “behind” where we’d like to be, financially.

We need to find our way home.

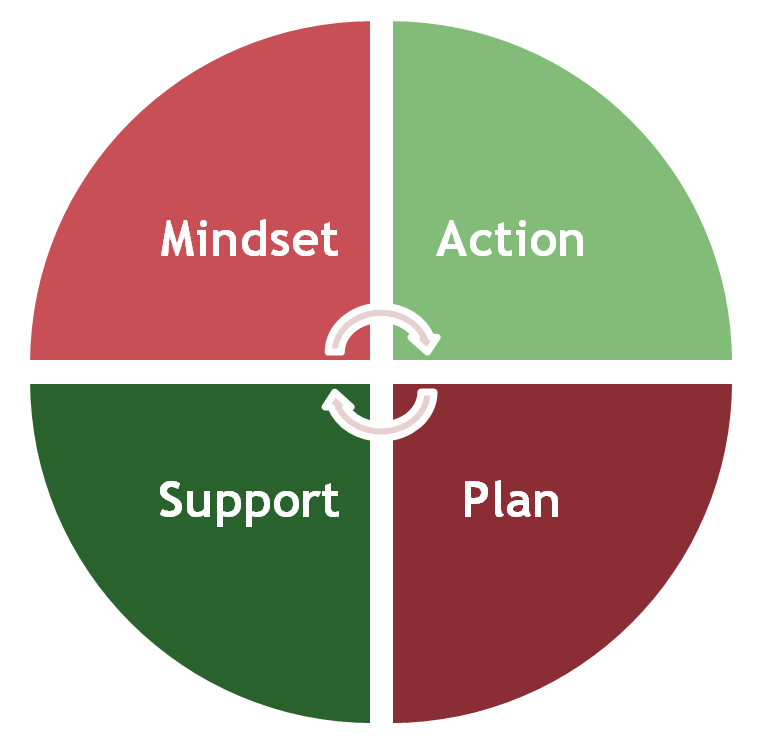

What we need is a Treasure MAP – or M.A.P.S.

1. “M” – Mindset

We need a mindset that supports wealth. We need to transform our belief systems, our attitudes, our emotions around money. This is the most important and most neglected part of the wealth formula! Without a healthy mindset around money, we will only sabotage ourselves.

2. “A” – Action.

We need to take consistent action towards our goals. We need healthy habits that support our dreams. We need to first stop procrastinating and begin to first do the things we know to do. Then we need to trust that we will discover our best “next steps” as we go.

3. “P” – Plan

We need a plan–a path to follow. We need sound strategies for raising our income, lowering our debt, and lessening the stress we feel whenever we think about money. A business strategy that works (if we are entrepreneurs), and a personal plan that works. Times are a-changing and we must change with them.

4. “S” – Support

We need support along the way. Let’s be real, we haven’t managed to accomplish the above on our own so far, so we’re going to need (and want!) help, guidance and support for the journey.

And finally, we need to be Wealthy, Worthy, and Wise.

We can be Wealthy in every way, we don’t have to settle for an “either/or” life in which we justify our lack of financial means by saying it’s “not that important.”

We can be Wealthy in every way, we don’t have to settle for an “either/or” life in which we justify our lack of financial means by saying it’s “not that important.”

We can realize our Worth that does not depend on outside circumstances, appearances, or other people’s approval, but the worth that comes from the inside out like rays emanating from the sun.

And we can be not just smart, but truly Wise. We can live in a way that is loving and peaceful, joyful and ultimately fulfilling, inside and out.

If this sounds like a journey that you’d be interested in, then I look forward to meeting or speaking to you soon. That’s why I do what I do, to help people live richer lives, in all ways.

Be sure to download my short ebook below, and visit the Total Wealth blog. (Comments and questions welcome!)

Be sure to download my short ebook below, and visit the Total Wealth blog. (Comments and questions welcome!)

And remember–You are powerful. You are worthy. You are abundant. And you are FREE!

In gratitude and abundance,

Kate Phillips

Would you like my new ebook, “Break Through to Abundance” FREE!?

Sign up during my limited time offer below:

You’ll also receive occasional Total Wealth updates.

Of course you can unsubscribe at any time, but why would you?