How to Recover from a Financial Setback

The truth about financial loss and the path to prosperity.

Nearly every American will experience multiple financial setbacks during their lifetimes. Incomes fluctuate. Investments fail. Emergencies strike. Life happens.

Nearly every American will experience multiple financial setbacks during their lifetimes. Incomes fluctuate. Investments fail. Emergencies strike. Life happens.

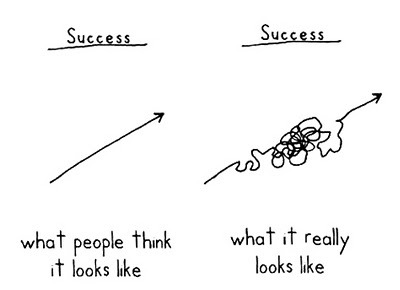

Very few people travel a straight road to financial success. Most of us encounter detours, potholes, even road blocks and dead ends along the way.

According to a 2017 study by the National Endowment for Financial Education reported in Forbes.com, 96% of Americans experience four or more major life events (layoff, illness, divorce, etc.) by age 70 that cause their incomes to drop 10% or more. By age 61, three out of four workers have gone without income for a year or more at least once.

Virtually every investor experiences losses, whether in the stock market, real estate market, or other investments.

Then there are the unexpected emergencies. Death, divorce, disability, and disasters of every kind. Even those who are “prepared” cannot anticipate every possibility.

Sometimes, our maps are incomplete. Our sense of direction is wrong. Our guidance systems are less than perfect. We get blindsided by obstacles and perhaps have to change course.

How can we respond when we receive bad financial news? How should we move forward when:

- the market tanks

- interest rates fall

- a business fails

- an investment sours

- or we suffer an unexpected loss?

Let’s examine financial setbacks through a holistic lens. What are the mental, physical, financial and emotional aspects of financial loss? How can we best set ourselves up for a full recovery? To answer, I’ll use my own Financial P.E.A.C.E. framework: a formula for financial stress reduction.

P: Adopt a PERSPECTIVE of Prosperity

A financial setback challenges even the most positive of mindsets. It is easy to get caught up in the “would’ve, could’ve, should’ves.” Our minds drift to the past or the future in ways that don’t serve us well. We may look back in regret, or look forward with fear. We are tempted to focus on what went wrong, not on what we can do next.

There’s a great story attributed to Tom Watson, Jr., the CEO of IBM from the mid-50’s until the early 70’s. As it goes, a young executive had made some bad business decisions that cost the company nearly a million dollars. He was summoned to Watson’s office, fully expecting to be chastised and fired. However, Watson had a different thought. He is said to have replied, “Fire you!? Young man, we just spent nearly a million dollars training you!”

A Perspective of Prosperity sees possibilities.

It interprets “mistakes” as learning experiences. It means taking responsibility for how you think. (“THINK” is also the first of Kim Butler’s 7 Principles of Prosperity.)

A Perspective of Prosperity involves the discipline of gratitude.

It requires the ability to look for the big picture—including valuable lessons and silver linings, even when we can’t see them yet. It involves adopting beliefs that support you and affirm your value—especially in challenging circumstances.

Ultimately, having a prosperous, positive Perspective is a willingness to “see” things differently.

E: EMPOWER Your Experience

Sometimes, our initial reaction to a difficult circumstance isn’t particularly empowering. We might panic, overreact, beat ourselves up, or become overwhelmed by anger or fear.

Dr. Sue Morter offers a piece of wisdom that is relevant to financial setbacks. “We may not be able to control our environment, but we can master our experience.”

What does it mean to master our experience? It looks like facing challenges head on, confident of our ability to improve whatever circumstance we find ourselves in. It means staying awake to the lessons we are learning, even when they are difficult. It means controlling the things that we can control, and realizing what we cannot control.

Staying empowered in the midst of financial loss requires us to respond with self-control, intentionality and integrity.

You master your experience when you deal with facts, not fears.

I’ve seen investors have drama around temporary market “losses” that are never realized. For instance, the market experiences a correction, but the stock is not sold and there is no “loss.” That person’s life hasn’t changed one iota—except for their state of mind. The stock may even bounce back in a few days or weeks. Yet how many people became mired in drama after the correction?

Other times, the loss is definite and final. It may be partial or total. It may be the result of investment risk, market cycles, theft, fraud, or just bad luck. Seek clarity and deal in facts.

You master your experience when you accept responsibility, when and where appropriate.

Financial psychologist Brad Klontz gives this advice in a Bankrate article, “You have to look at what your part was in this situation. The temptation, of course, is (to say), ‘It wasn’t me. It was the economy. It was the greedy bank,’ and that’s all probably true, but there’s really no learning opportunity from externalizing the blame.”

You master your experience when you don’t allow a financial setback to undermine your sense of self worth.

Financial loss can lead to a crisis of confidence and a downward spiral, but it doesn’t have to. I love what financial educator Saundra Davis says about recovering from a financial setback: “Learn the lesson, leave the shame.”

You empower your experience when you practice excellent self-care.

When stress or anxiety gets the best of you, it’s easy to neglect basic needs, which can make your situation feel even worse than it is. Make sure you’re still getting adequate sleep and eating properly. Avoid unhealthy coping strategies, such as self-medicating or over-indulging with food or alcohol. Stay in good shape mentally and physically and it will assist you in taking control of your finances and turning things around for the better.

People who reach the pinnacle of success have learned to handle the speed bumps, detours and road blocks. They have developed resiliency, discipline, and the ability to overcome obstacles. They find a way to learn and grow stronger from each and every setback.

Master your experience and transform your circumstances.

A: ACT in Alignment with Abundance.

When losses occur, we tend to react—or perhaps overreact. Conversely, some people become frozen in fear and fail to take action when they should.

When losses occur, we tend to react—or perhaps overreact. Conversely, some people become frozen in fear and fail to take action when they should.

Overwhelm is a natural response to financial loss, but small action steps can work wonders. The actual steps may be different for each situation, yet you probably intuitively know one or more steps you could take now.

First, assess the situation.Is this a temporary setback, or something that could impact you for many years to come? What caused the setback—and did it involve any recurring patterns or habits? What is the exact loss, and how will it impact your savings, investments, or cash flow? Get an accurate picture of the setback and its significance. This will help you determine the right course of action and eliminate anxiety about the unknown.

Decide your next steps. Determine what you want to accomplish, and chunk it down into manageable pieces. If you sincerely don’t know what action to take, perhaps doing research or getting financial advice is your next step.

Begin. Not sure where to start? Or do you find yourself procrastinating? Get help and support from a friend, family member, or professional.

Fear, anxiety and overwhelm dissipate with doing.

C: CARE for Your Cash

In any crisis, it’s essential to pay attention to your cash, the safe part of your portfolio, as well as your cash flow, which pays your living expenses. Some ways to get more control of your cash include:

In any crisis, it’s essential to pay attention to your cash, the safe part of your portfolio, as well as your cash flow, which pays your living expenses. Some ways to get more control of your cash include:

Adjust your spending.

“The biggest key to long-term recovery after a financial shock is to resize your spending to your new reality,” says Rachel Schneider, co-author of The Financial Diaries: How American Families Cope in a World of Uncertainty in a Forbes article. However, Schneider also advises that you pay attention to what you can’t eliminate without compromising your emotional well-being. Love to travel or eat out? Find ways to still enjoy those perks for less.

Double down on savings.

When you experience a financial setback, there may be a temptation to double down on risk and “go for it.” Running the ball towards the goal line hasn’t worked as you hoped, so you consider throwing a “Hail Mary,” betting on a long shot to help you reach your goals. But this is the wrong solution. In reality, your SAVINGS is what you fall back on when investments fail.

Reduce your taxes.

Now might be a good time to re-evaluate your tax strategy. We love the WealthAbility show, not only for Tom Wheelwright’s great advice on taxes and wealth-building, but also for his positive, can-do attitude about money. Finding some “wins” on your balance sheet will help your bottom line and help alleviate feelings of overwhelm.

Have the courage to change the things you can.

E: ENVISION a Future of “Enough.”

As important as it is to “stay present” in times of loss, it’s also essential to develop a powerful vision for the future that draws you forward into the future you want to create.

As important as it is to “stay present” in times of loss, it’s also essential to develop a powerful vision for the future that draws you forward into the future you want to create.

Having this vision for your abundant life is especially important after an economic loss. A financial setback can be an emotional shock. Ignored and suppressed, that shock can turn into deep emotional wounds. Unhealed financial wounds can produce a lifetimes of financial pain.

There are processes and practices that may assist you. For instance, journaling can bring what is unconscious up to the surface. Journaling a conversation with money can be an enlightening practice. Goal-setting, vision boarding, meditation and mastermind groups are all powerful practices that help you move forward.

Whatever your preferred method…

Dare to envision a future that is bigger than your past.

If you have lost a business, you may become too ashamed to try entrepreneurship again.

Dream and do anyway.

If you have lost half or more of your wealth in a divorce, you might be tempted to get a cat and stay single for the rest of your life.

Dare to love anyway.

If you have been fired from a job, you may experience a loss of confidence.

Believe in yourself anyway.

Foreclosure could leave you resolved to rent for the rest of your life—in spite of the loss of control and lack of equity you will have as a renter.

Envision that perfect-for-you home anyway.

Unexpected loss can lead you to play it so safe that there is little to gain.

Live and invest fully anyway.

Making a big financial mistake of any kind can lead to financial shame and second-guessing yourself.

Love and forgive yourself anyway.

Envision the life you want and the circumstances we wish to bring about. Imagine the life you are committed to having and the kind of person you wish to be. As you do, reality can shift in an instant.

“Thoughts become things… choose them wisely.” (Mike Dooley)

Had Enough of Money Worries?

Have you had a financial setback? Do you find yourself stressing about finances – regardless of how much or how little you have?

Have you had a financial setback? Do you find yourself stressing about finances – regardless of how much or how little you have?

In November, I will be offering The Financial Stress Solution, a course you can attend virtually. Sign up to receive my 22-page ebook, Breakthrough to Abundance: Four Reasons You’re Stressing Over Money and How to Break the Cycle Forever! and you will be placed on the notification list!

I also invite you to read my previous post on our Prosperity Blog, “Preparing for a Financial Resurrection.”

About Kate Phillips. Hi! I’m the founder of Total Wealth Coaching and co-author (with Kim Butler) of Financial Planning Has Failed. A pioneer in financial therapy (before I knew that was an official thing), I help people free themselves from financial stress. My stand is for people to know themselves as powerful, worthy and abundant!

About Kate Phillips. Hi! I’m the founder of Total Wealth Coaching and co-author (with Kim Butler) of Financial Planning Has Failed. A pioneer in financial therapy (before I knew that was an official thing), I help people free themselves from financial stress. My stand is for people to know themselves as powerful, worthy and abundant!

Want to stay in touch?

If you’re not already on my mailing list, opt in for my Break Through to Abundance ebook below and “like” my Total Wealth Facebook page.

Get the eBook:

Break Through to Abundance: 4 Reasons You’re Stressing About Money… and How to Break the Cycle Forever!

Discover WHY you’re stressing about money and how to STOP!

You’ll receive occasional updates with Total Wealth wisdom and inspiration. You can unsubscribe at any time, but why would you?